Stock Market Outperformers - March 07, 2025

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Market Overview

Daily Market Outperformers Analysis

Date: March 9, 2025Market Overview

Today's market shows notable strength across multiple sectors, with healthcare, technology, energy, and consumer stocks all appearing among the top performers. The diverse nature of today's outperformers suggests a broad-based rally rather than sector-specific momentum. Particularly interesting is the strong showing from both speculative small-cap stocks (such as Silexion and Novo Integrated Sciences) alongside established players (like e.l.f. Beauty and Sandisk), indicating improved risk appetite across the investment spectrum. Healthcare and technology continue to demonstrate resilience, with biotechnology and quantum computing stocks showing significant positive momentum. The energy sector is also showing signs of recovery, potentially signaling changing market sentiment about commodity prices. This cross-sector strength comes amid a market that appears to be gaining confidence after the volatility we've seen throughout early 2025.Individual Stock Analysis

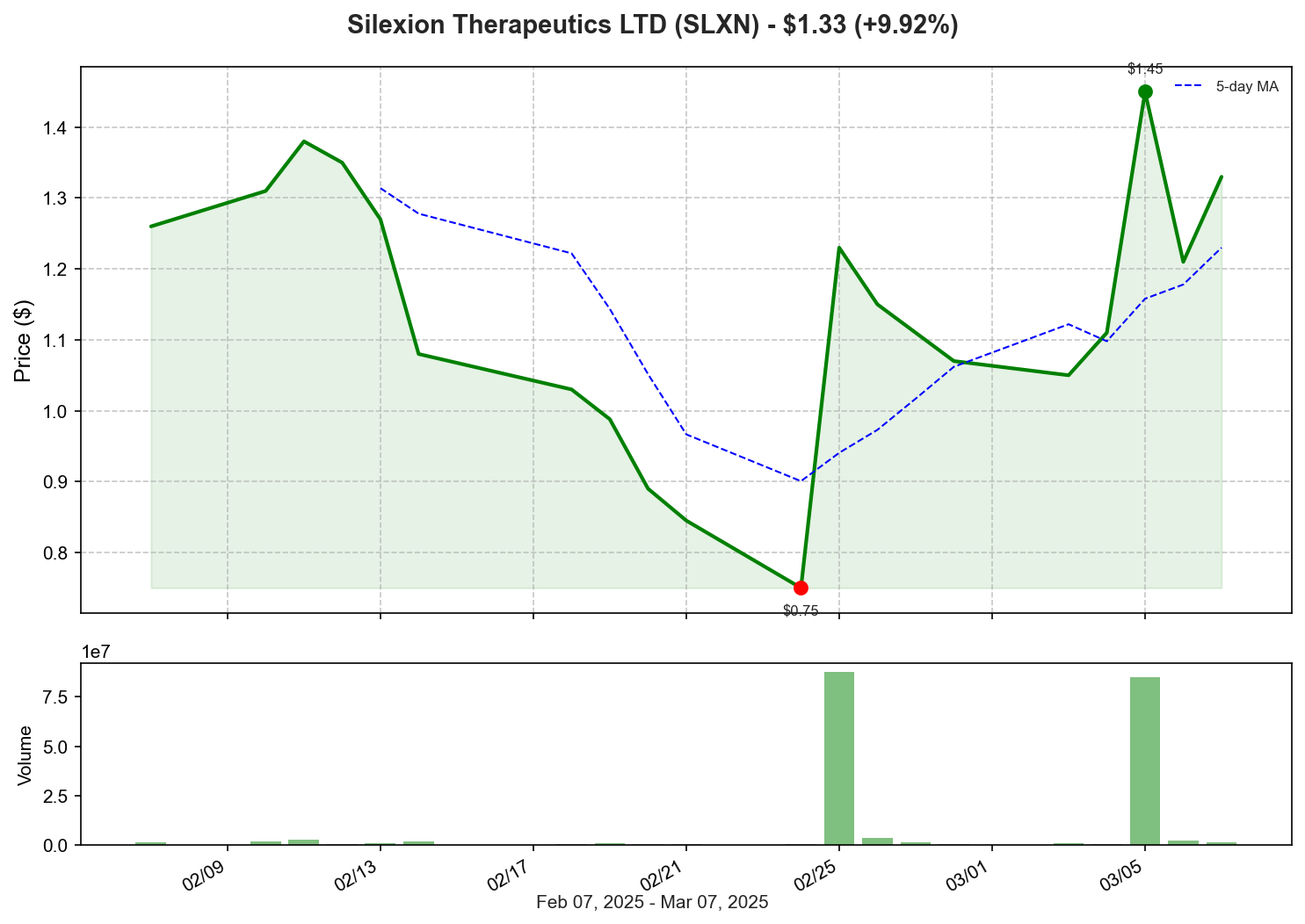

1. Silexion Therapeutics LTD (SLXN) - Up 9.92%

Analysis: Silexion's substantial gain today extends its impressive weekly rally of nearly 20%, likely driven by the recent positive preclinical data for its pancreatic cancer candidate SIL204. The March 5th announcement of tumor reduction in orthotopic pancreatic cancer models represents a significant milestone for this small biotech company. Context: With pancreatic cancer being one of the most lethal and treatment-resistant cancers, successful preclinical results typically generate strong market interest. The company's small market cap (approximately $11.2 million) makes it particularly sensitive to positive developments. Investors appear to be pricing in the potential value of SIL204 as it moves closer to potential clinical trials, though the stock remains speculative given its early-stage pipeline.2. Rigetti Computing, Inc. (RGTI) - Up 9.87%

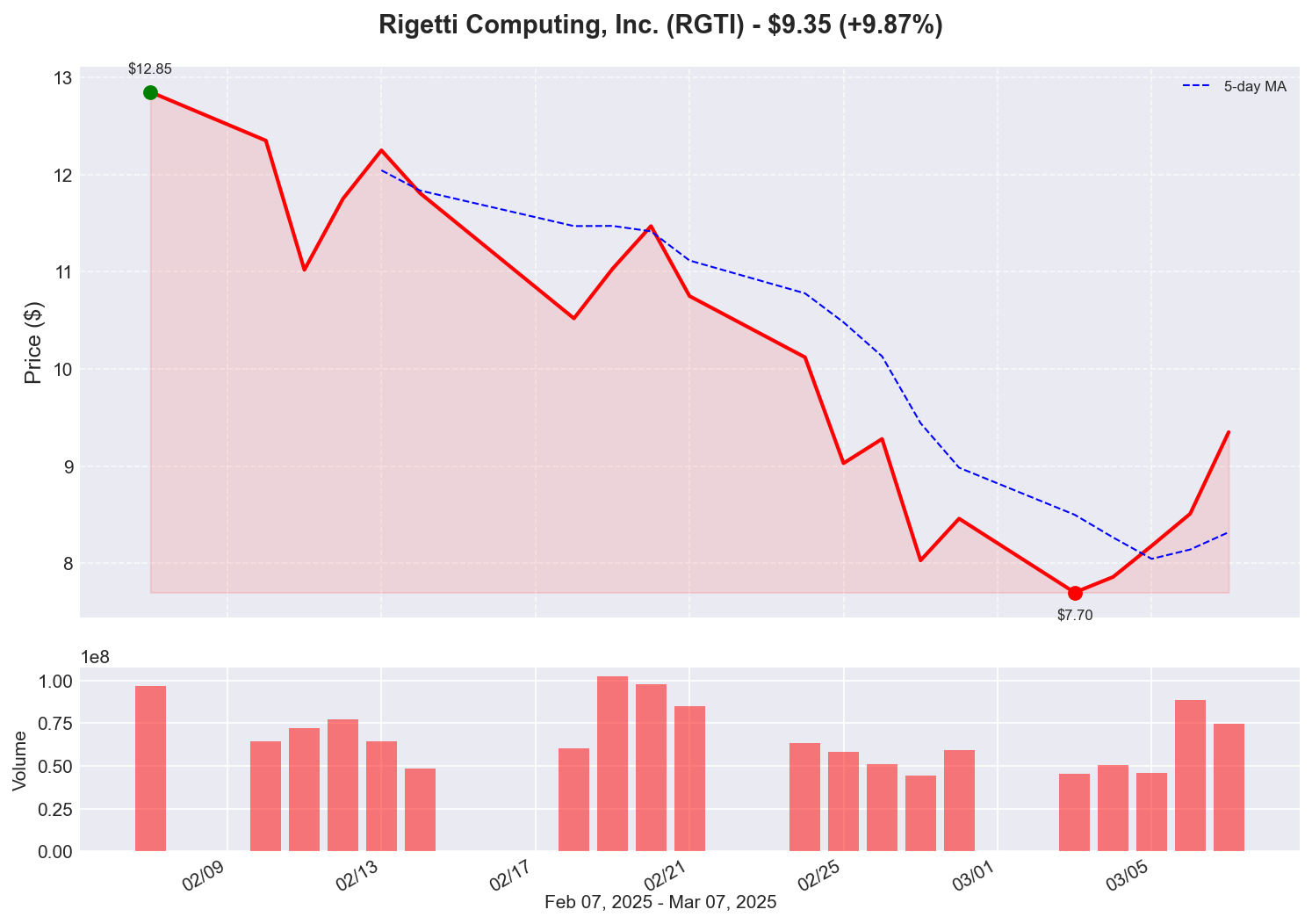

Analysis: Rigetti's strong performance today is particularly interesting given the mixed reactions to its recent earnings report. Despite some negative analyst commentary, investors seem to be focusing on the longer-term potential of quantum computing technology. Context: Quantum computing represents a frontier technology with transformative potential across multiple industries. Rigetti's continued advancement in this space positions it as one of the few pure-play quantum computing investments available. The recovery today may indicate that after initial disappointment, investors are reassessing the company's progress and competitive positioning in this rapidly evolving sector. The conflicting analyst opinions highlight the speculative nature of investments in early-stage quantum computing companies.3. Faraday Future Intelligent Electric Inc. (FFIE) - Up 9.85%

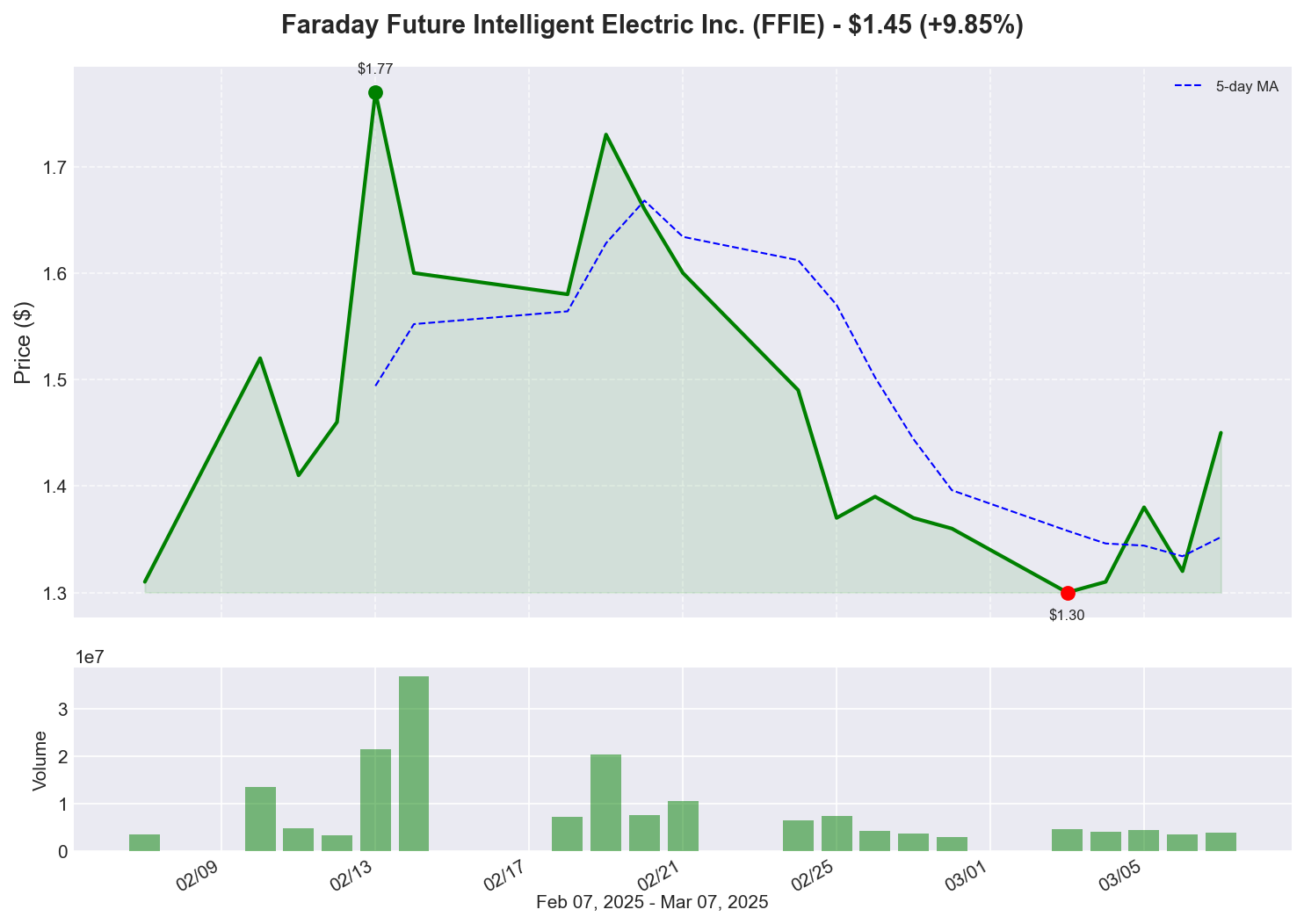

Analysis: Faraday Future's rally comes just days after announcing its ticker symbol change to "FFAI," effectively repositioning itself to highlight its artificial intelligence capabilities rather than just its electric vehicle operations. Context: The company's upcoming "FF Open AI Day" on March 16th appears to be generating anticipation, as Faraday attempts to capitalize on investor enthusiasm for AI-related stocks. This strategic pivot to emphasize its AI integration in automotive technology represents a broader trend in the EV market, where companies are increasingly differentiating themselves through software and intelligence capabilities rather than just hardware specifications. The stock remains highly volatile due to the company's challenging path to production and profitability.4. Maxeon Solar Technologies, Ltd. (MAXN) - Up 9.84%

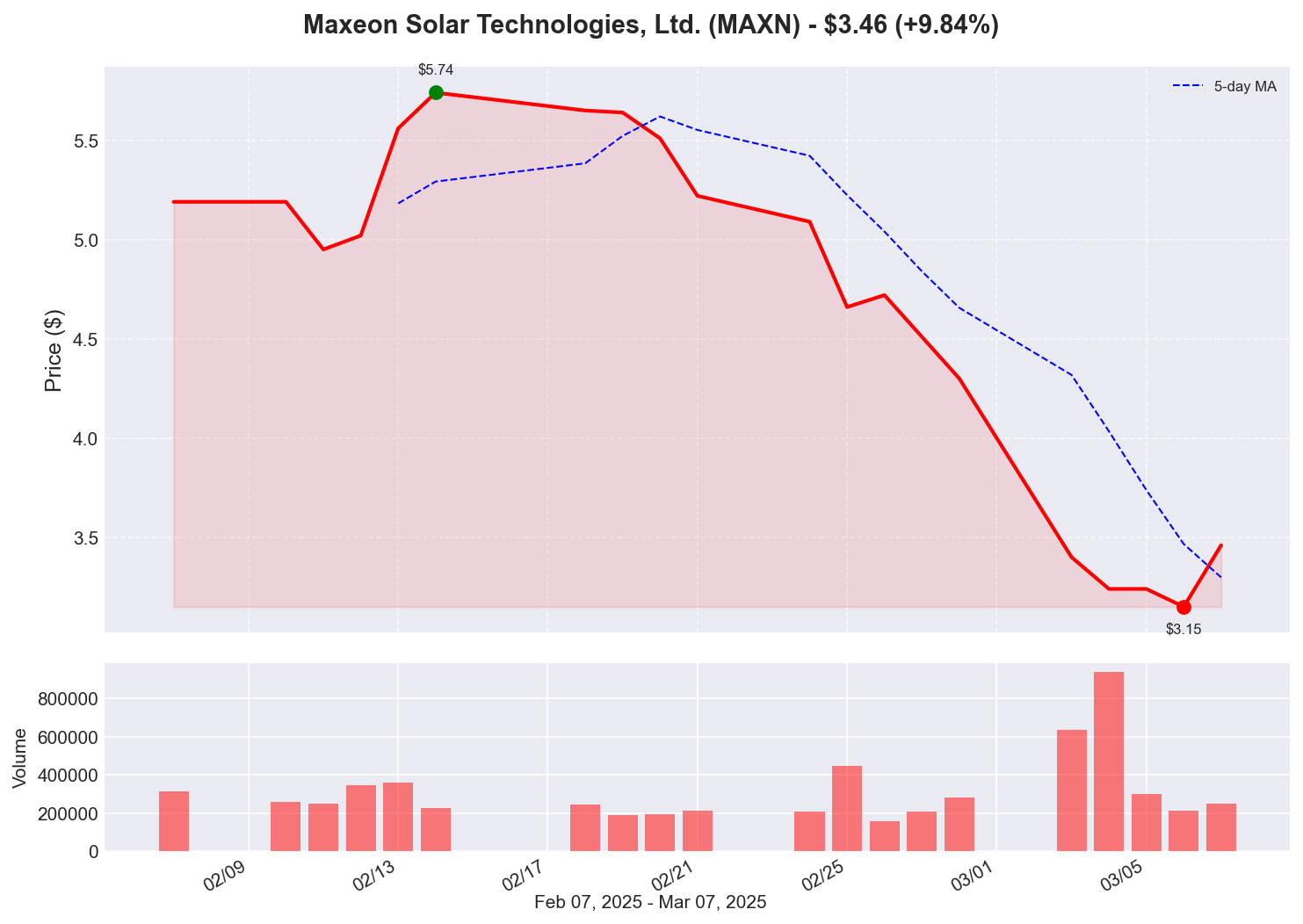

Analysis: Maxeon's strong performance today comes despite a concerning weekly decline of over 23%. This suggests a potential technical bounce after a significant selloff. Context: The solar sector has faced headwinds in recent months due to rising interest rates affecting project financing and installation growth. With limited company-specific news, Maxeon's rally may represent opportunistic buying after recent weakness rather than a fundamental change in outlook. The solar industry remains in a transition period, adjusting to post-pandemic supply chain normalization and evolving government incentive structures.5. Transocean Ltd. (RIG) - Up 9.75%

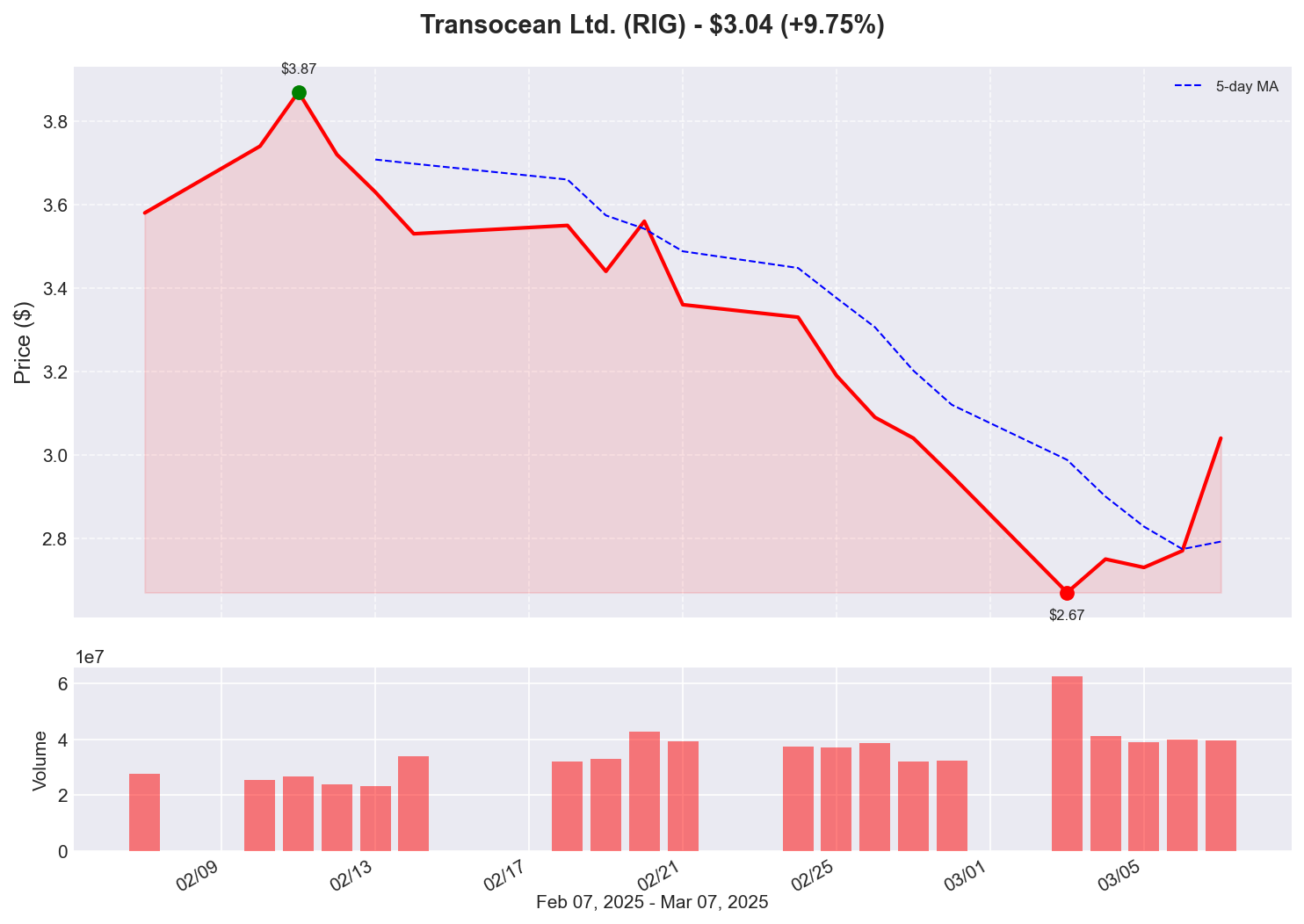

Analysis: Transocean's nearly 10% gain today occurs amid increasing discussions about stagflation and its potential impact on commodity prices, particularly in the energy sector. Context: As an offshore drilling contractor, Transocean's business is highly sensitive to oil price expectations and drilling activity levels. The company has been navigating a challenging environment of high debt levels and industry overcapacity. Today's move could reflect changing investor perceptions about energy demand and pricing, particularly if stagflation concerns are driving interest in commodity-linked stocks as inflation hedges. The offshore drilling sector has been slow to recover from previous downturns, making Transocean's substantial move today particularly notable.6. e.l.f. Beauty, Inc. (ELF) - Up 9.72%

Analysis: e.l.f. Beauty's strong performance is occurring despite multiple announced shareholder lawsuits, suggesting investors may be discounting the legal challenges as temporary or immaterial to the company's underlying business strength. Context: e.l.f. has been one of the standout performers in the beauty sector in recent years, capitalizing on effective social media marketing, value pricing, and strong product innovation. The lawsuits appear to relate to securities law violations, but the market seems to be focusing instead on the company's operational momentum and market share gains against larger competitors. The beauty industry has demonstrated resilience throughout economic cycles, and e.l.f.'s positioning in the affordable luxury segment has resonated with consumers.7. Sandisk Corporation (SNDK) - Up 9.68%

Analysis: Sandisk's strong performance extends its impressive weekly gain of nearly 13%. Recent positive analyst notes appear to be driving continued enthusiasm for the stock. Context: As a major player in storage solutions, Sandisk is well-positioned to benefit from increasing data storage demands driven by AI applications and cloud computing growth. The memory and storage market has historically been cyclical, but structural demand growth from emerging technologies may be creating more sustainable growth opportunities. Analysts appear increasingly confident in Sandisk's competitive positioning and ability to capitalize on these trends.8. XTI Aerospace, Inc. (XTIA) - Up 9.61%

Analysis: XTI Aerospace's gain occurs without significant company-specific news, suggesting broader sector momentum or speculative interest in the small-cap aerospace company. Context: With a market cap of just under $11 million, XTIA represents a highly speculative investment in the aerospace sector. The defense and aerospace industries have generally benefited from geopolitical tensions and increased defense spending globally. As a microcap stock, XTIA is particularly susceptible to volatility from relatively small changes in trading volume or investor sentiment.9. Big Tree Cloud Holdings Limited (DSY) - Up 9.49%

Analysis: Big Tree Cloud's performance today comes despite a concerning weekly decline of over 12%, indicating a potential technical rebound rather than fundamental improvement. Context: As a consumer products company with cloud integration, Big Tree operates at the intersection of traditional consumer goods and technology. The stock's volatility reflects both the challenges of this hybrid business model and its relatively small market cap of approximately $99 million. Without significant news catalysts, today's move likely represents trading dynamics rather than material developments.10. Novo Integrated Sciences, Inc. (NVOS) - Up 9.43%

Analysis: Novo Integrated Sciences continues its positive momentum, adding to a weekly gain of over 12%. At just $0.065 per share and a micro market cap of $1.28 million, NVOS represents an extremely speculative investment. Context: The healthcare facilities sector has faced challenges related to staffing costs and operational pressures. Novo's extremely small market capitalization makes it susceptible to significant percentage moves on minimal trading volume. The stock's performance should be viewed in the context of its penny stock status and the inherent volatility associated with companies of this size in the healthcare sector.Conclusion

Today's outperformers represent a diverse cross-section of the market, spanning from innovative biotechnology and quantum computing companies to more established players in beauty and energy. This breadth of performance across sectors suggests improving market sentiment rather than sector rotation. Several key themes emerge from today's top performers: 1. Innovation Premium: Companies highlighting technological advancement (Rigetti, Faraday Future, Silexion) are being rewarded, reflecting ongoing investor appetite for innovation despite recent market volatility. 2. Recovery Opportunities: Stocks that had experienced significant prior weakness (Maxeon, Big Tree) showed notable rebounds, suggesting opportunistic buying at perceived value points. 3. Legal Challenges Discounted: e.l.f. Beauty's performance despite legal headwinds indicates investors are focusing on fundamental business strength over potential short-term legal complications. 4. Micro-Cap Speculation: The presence of several extremely small companies among top performers (Silexion, XTI, Novo) points to increased risk appetite and speculative trading activity. For investors, these patterns suggest a market that is becoming more discerning about quality while still maintaining appetite for speculative opportunities with significant growth potential. The technology and healthcare sectors continue to demonstrate leadership, while energy shows signs of renewed interest. Moving forward, monitoring whether this broad-based strength can be sustained will be crucial. Particular attention should be paid to upcoming Federal Reserve communications and inflation data, which could significantly impact market sentiment, especially for the more speculative names that featured prominently among today's outperformers.

Featured Stocks

Silexion Therapeutics LTD (SLXN)

N/A

['### 1. Silexion Therapeutics LTD (SLXN) - Up 9.92%', "**Analysis:** Silexion's substantial gain today extends its impressive weekly rally of nearly 20%, likely driven by the recent positive preclinical data for its pancreatic cancer candidate SIL204. The March 5th announcement of tumor reduction in orthotopic pancreatic cancer models represents a significant milestone for this small biotech company.", "**Context:** With pancreatic cancer being one of the most lethal and treatment-resistant cancers, successful preclinical results typically generate strong market interest. The company's small market cap (approximately $11.2 million) makes it particularly sensitive to positive developments. Investors appear to be pricing in the potential value of SIL204 as it moves closer to potential clinical trials, though the stock remains speculative given its early-stage pipeline."]

Rigetti Computing, Inc. (RGTI)

N/A

['### 2. Rigetti Computing, Inc. (RGTI) - Up 9.87%', "**Analysis:** Rigetti's strong performance today is particularly interesting given the mixed reactions to its recent earnings report. Despite some negative analyst commentary, investors seem to be focusing on the longer-term potential of quantum computing technology.", "**Context:** Quantum computing represents a frontier technology with transformative potential across multiple industries. Rigetti's continued advancement in this space positions it as one of the few pure-play quantum computing investments available. The recovery today may indicate that after initial disappointment, investors are reassessing the company's progress and competitive positioning in this rapidly evolving sector. The conflicting analyst opinions highlight the speculative nature of investments in early-stage quantum computing companies."]

Faraday Future Intelligent Electric Inc. (FFIE)

N/A

['### 3. Faraday Future Intelligent Electric Inc. (FFIE) - Up 9.85%', '**Analysis:** Faraday Future\'s rally comes just days after announcing its ticker symbol change to "FFAI," effectively repositioning itself to highlight its artificial intelligence capabilities rather than just its electric vehicle operations.', '**Context:** The company\'s upcoming "FF Open AI Day" on March 16th appears to be generating anticipation, as Faraday attempts to capitalize on investor enthusiasm for AI-related stocks. This strategic pivot to emphasize its AI integration in automotive technology represents a broader trend in the EV market, where companies are increasingly differentiating themselves through software and intelligence capabilities rather than just hardware specifications. The stock remains highly volatile due to the company\'s challenging path to production and profitability.']

Maxeon Solar Technologies, Ltd. (MAXN)

N/A

['### 4. Maxeon Solar Technologies, Ltd. (MAXN) - Up 9.84%', "**Analysis:** Maxeon's strong performance today comes despite a concerning weekly decline of over 23%. This suggests a potential technical bounce after a significant selloff.", "**Context:** The solar sector has faced headwinds in recent months due to rising interest rates affecting project financing and installation growth. With limited company-specific news, Maxeon's rally may represent opportunistic buying after recent weakness rather than a fundamental change in outlook. The solar industry remains in a transition period, adjusting to post-pandemic supply chain normalization and evolving government incentive structures."]

Transocean Ltd. (RIG)

N/A

['### 5. Transocean Ltd. (RIG) - Up 9.75%', "**Analysis:** Transocean's nearly 10% gain today occurs amid increasing discussions about stagflation and its potential impact on commodity prices, particularly in the energy sector.", "**Context:** As an offshore drilling contractor, Transocean's business is highly sensitive to oil price expectations and drilling activity levels. The company has been navigating a challenging environment of high debt levels and industry overcapacity. Today's move could reflect changing investor perceptions about energy demand and pricing, particularly if stagflation concerns are driving interest in commodity-linked stocks as inflation hedges. The offshore drilling sector has been slow to recover from previous downturns, making Transocean's substantial move today particularly notable."]