Novo Integrated Sciences, Inc. (NVOS) Analysis

By Elena Patel

Portfolio Manager, CFA, CFP

Stock Overview

$0.065

+$0.01 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

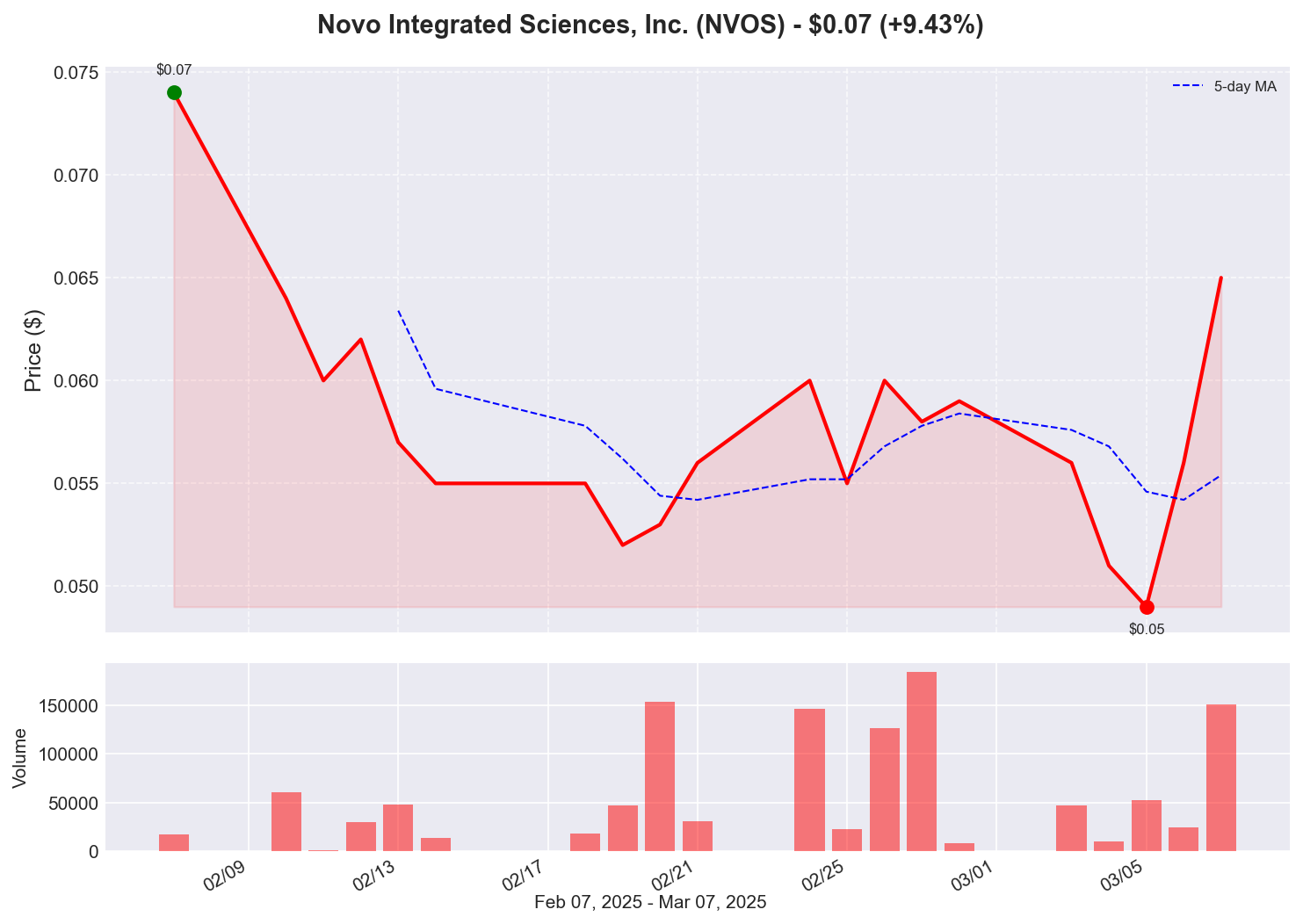

10. Novo Integrated Sciences, Inc. (NVOS) - Up 9.43%

Analysis: Novo Integrated Sciences continues its positive momentum, adding to a weekly gain of over 12%. At just $0.065 per share and a micro market cap of $1.28 million, NVOS represents an extremely speculative investment. Context: The healthcare facilities sector has faced challenges related to staffing costs and operational pressures. Novo's extremely small market capitalization makes it susceptible to significant percentage moves on minimal trading volume. The stock's performance should be viewed in the context of its penny stock status and the inherent volatility associated with companies of this size in the healthcare sector.Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates: