Maxeon Solar Technologies, Ltd. (MAXN) Analysis

By Sophia Williams

Emerging Technologies Research Director, Ph.D.

Stock Overview

$3.46

+$0.31 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

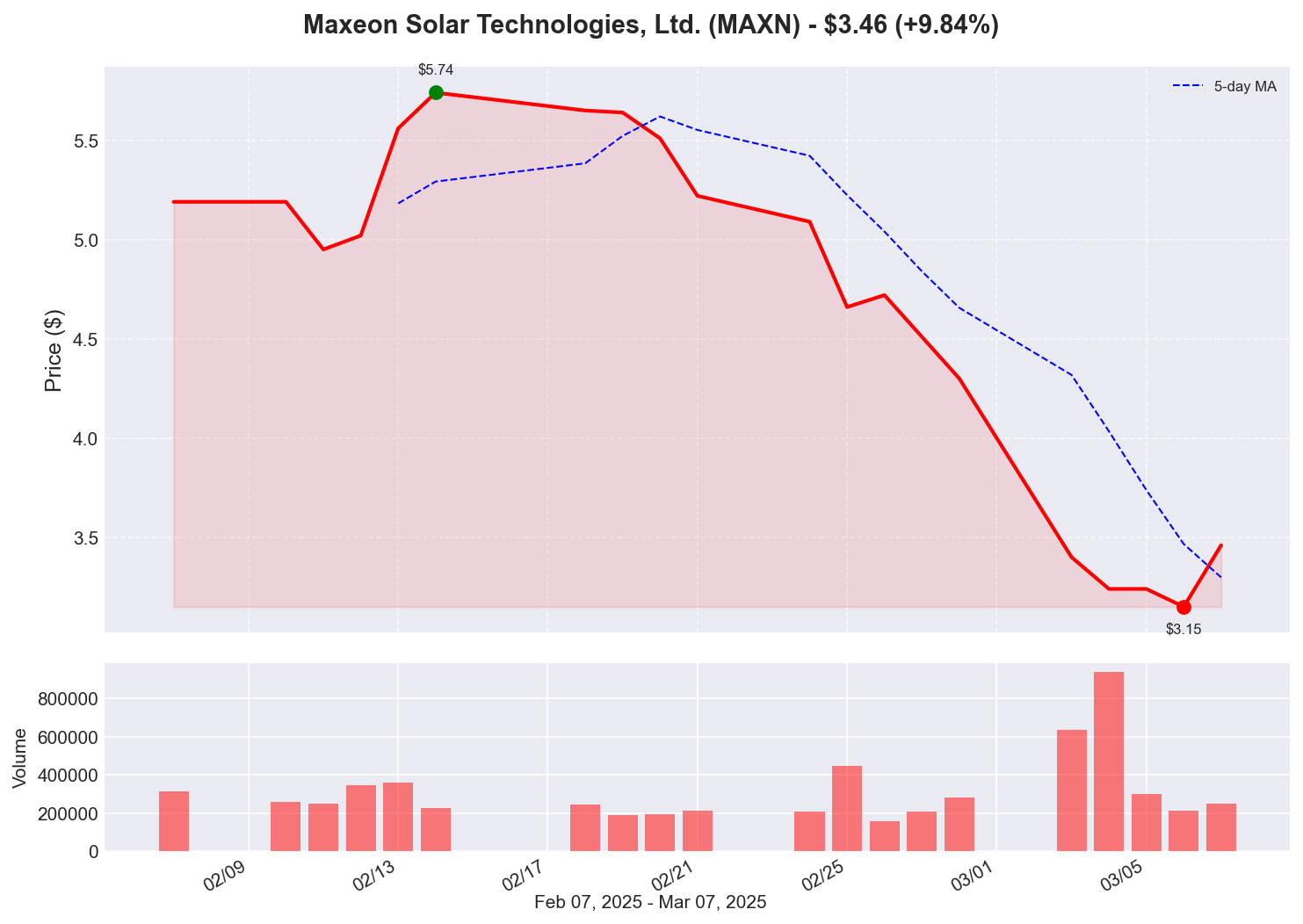

4. Maxeon Solar Technologies, Ltd. (MAXN) - Up 9.84%

Analysis: Maxeon's strong performance today comes despite a concerning weekly decline of over 23%. This suggests a potential technical bounce after a significant selloff. Context: The solar sector has faced headwinds in recent months due to rising interest rates affecting project financing and installation growth. With limited company-specific news, Maxeon's rally may represent opportunistic buying after recent weakness rather than a fundamental change in outlook. The solar industry remains in a transition period, adjusting to post-pandemic supply chain normalization and evolving government incentive structures.Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates: