Transocean Ltd. (RIG) Analysis

By David Rodriguez

Technical Analysis Director, CMT

Stock Overview

$3.04

+$0.27 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

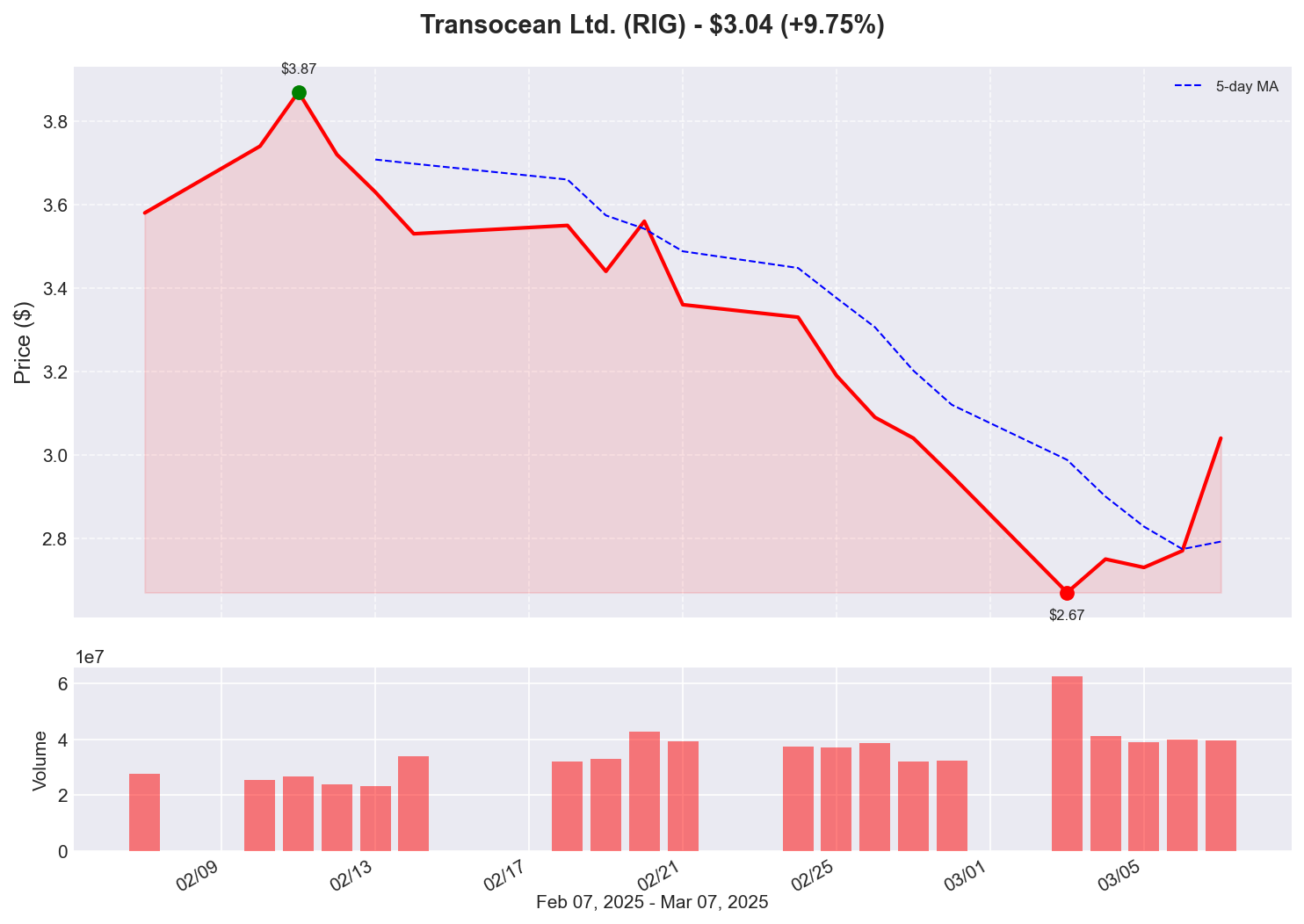

5. Transocean Ltd. (RIG) - Up 9.75%

Analysis: Transocean's nearly 10% gain today occurs amid increasing discussions about stagflation and its potential impact on commodity prices, particularly in the energy sector. Context: As an offshore drilling contractor, Transocean's business is highly sensitive to oil price expectations and drilling activity levels. The company has been navigating a challenging environment of high debt levels and industry overcapacity. Today's move could reflect changing investor perceptions about energy demand and pricing, particularly if stagflation concerns are driving interest in commodity-linked stocks as inflation hedges. The offshore drilling sector has been slow to recover from previous downturns, making Transocean's substantial move today particularly notable.Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates: