XTI Aerospace, Inc. (XTIA) Analysis

By Elena Patel

Portfolio Manager, CFA, CFP

Stock Overview

$3.08

+$0.27 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

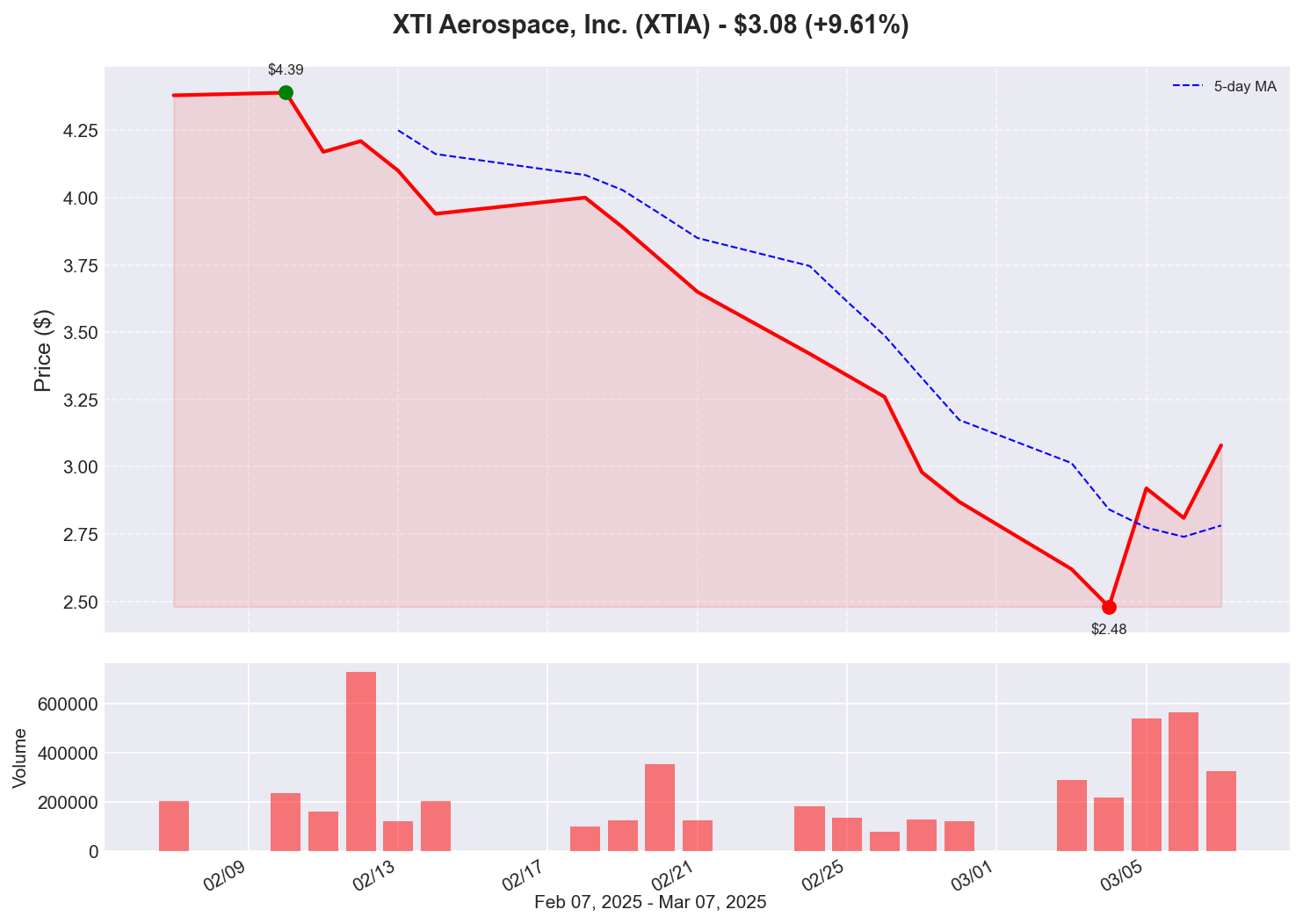

8. XTI Aerospace, Inc. (XTIA) - Up 9.61%

Analysis: XTI Aerospace's gain occurs without significant company-specific news, suggesting broader sector momentum or speculative interest in the small-cap aerospace company. Context: With a market cap of just under $11 million, XTIA represents a highly speculative investment in the aerospace sector. The defense and aerospace industries have generally benefited from geopolitical tensions and increased defense spending globally. As a microcap stock, XTIA is particularly susceptible to volatility from relatively small changes in trading volume or investor sentiment.Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates: