Sandisk Corporation (SNDK) Analysis

By Elena Patel

Portfolio Manager, CFA, CFP

Stock Overview

$51

+$4.50 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

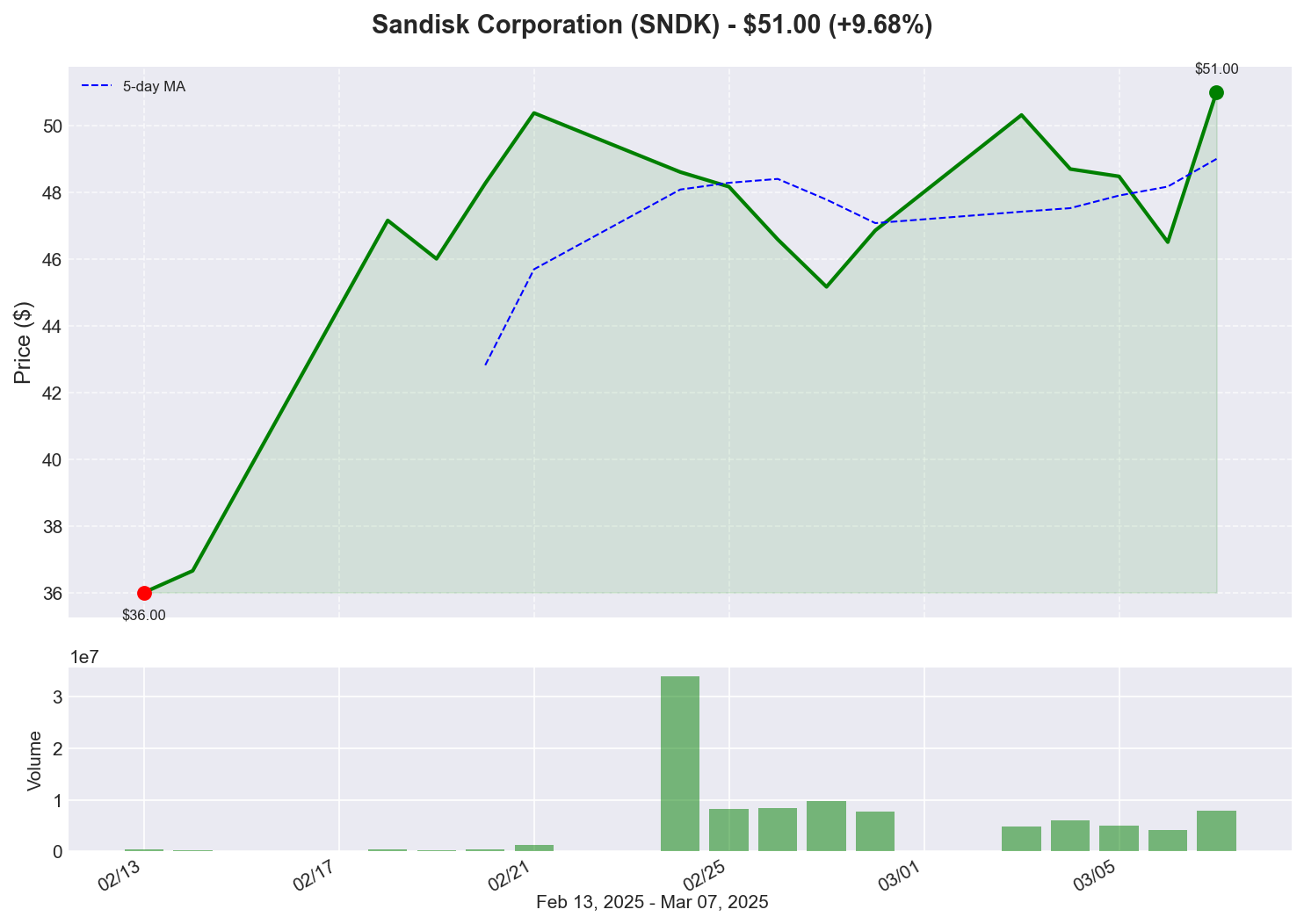

7. Sandisk Corporation (SNDK) - Up 9.68%

Analysis: Sandisk's strong performance extends its impressive weekly gain of nearly 13%. Recent positive analyst notes appear to be driving continued enthusiasm for the stock. Context: As a major player in storage solutions, Sandisk is well-positioned to benefit from increasing data storage demands driven by AI applications and cloud computing growth. The memory and storage market has historically been cyclical, but structural demand growth from emerging technologies may be creating more sustainable growth opportunities. Analysts appear increasingly confident in Sandisk's competitive positioning and ability to capitalize on these trends.Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates: