ProShares UltraShort Semiconductors (SSG) Analysis

Stock Overview

$33.49

+$2.94 (+0.00%)

Volume: 0

Sector: N/A

Industry: N/A

Price Chart

Technical Indicators

Moving Averages

50-Day MA: N/A

200-Day MA: N/A

Relative Strength Index (RSI)

RSI (14): N/A

Support & Resistance

Support: $N/A

Resistance: $N/A

52-Week Range

High: $N/A

Low: $N/A

Fundamental Data

Market Cap

N/A

P/E Ratio

N/A

EPS

$N/A

Beta

N/A

Analysis

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

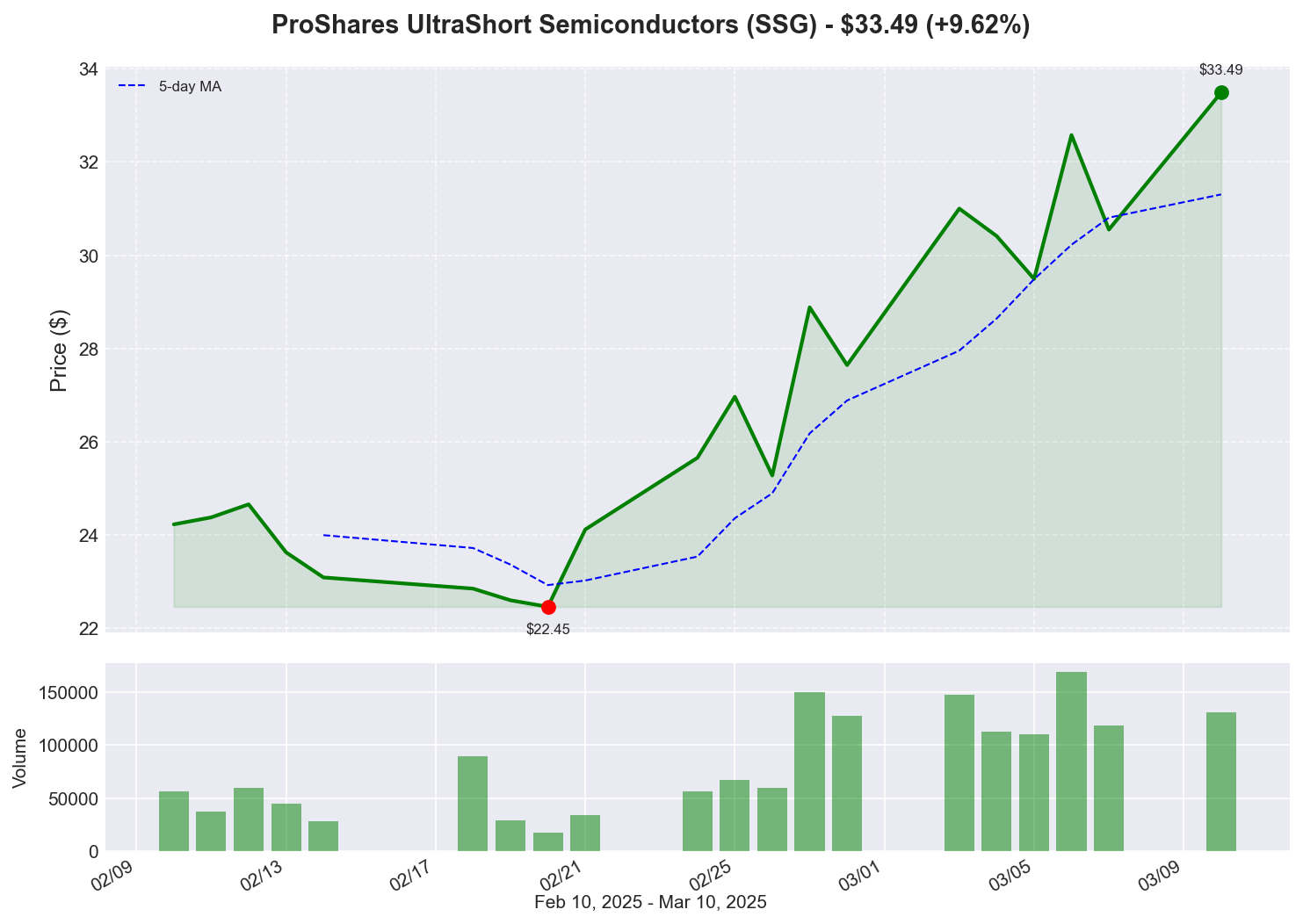

4. ProShares UltraShort Semiconductors (SSG) - Up 9.62%

Similar to AIBD, SSG is a leveraged inverse semiconductor ETF that rises when semiconductor stocks fall. The 9.62% gain indicates a significant drop in semiconductor stocks today. Given SSG's 21.16% weekly gain, there appears to be growing pessimism toward semiconductor valuations. This could be linked to concerns about chip oversupply, slowing demand in certain categories, or geopolitical tensions affecting global supply chains. The parallel movement with AIBD suggests a related causal factor affecting both AI and semiconductor companies, potentially tied to valuation concerns after extended bull runs in both sectors.Recent News

No recent news found for this stock.

Historical Performance

1 Day

N/A

1 Week

N/A

1 Month

N/A

3 Months

N/A

YTD

N/A

Historical Data

View this stock on other dates:

Recent News

No recent news found for this stock.