Stock Market Outperformers - March 11, 2025

Note: The analysis provided below is generated for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Market Overview

Market Outperformers Analysis: March 11, 2025

Market Overview

Today's market showed notable strength in several key sectors, with the top performers displaying significant upward movement against a backdrop of broader market volatility. Consumer Defensive, Healthcare, Technology, and Industrials sectors were particularly well-represented among today's outperformers, suggesting a rotation toward both defensive positions and growth opportunities in specific niches. The most dramatic movement came from Raytech Holding Limited with a nearly 95% gain, while several other stocks posted gains approaching 10%. This divergence in performance magnitude indicates stock-specific catalysts rather than broad sector movements driving today's standout performers. Healthcare was particularly well-represented with three companies in our top ten list, potentially reflecting renewed investor interest in biotech and pharmaceutical innovations. Many of these outperformers have shown strong momentum over the past week, suggesting continuation patterns rather than merely single-day anomalies. The presence of several small-cap and micro-cap companies in today's list points to increased risk appetite among some investors seeking higher-return opportunities outside of large-cap stability.Individual Stock Analysis

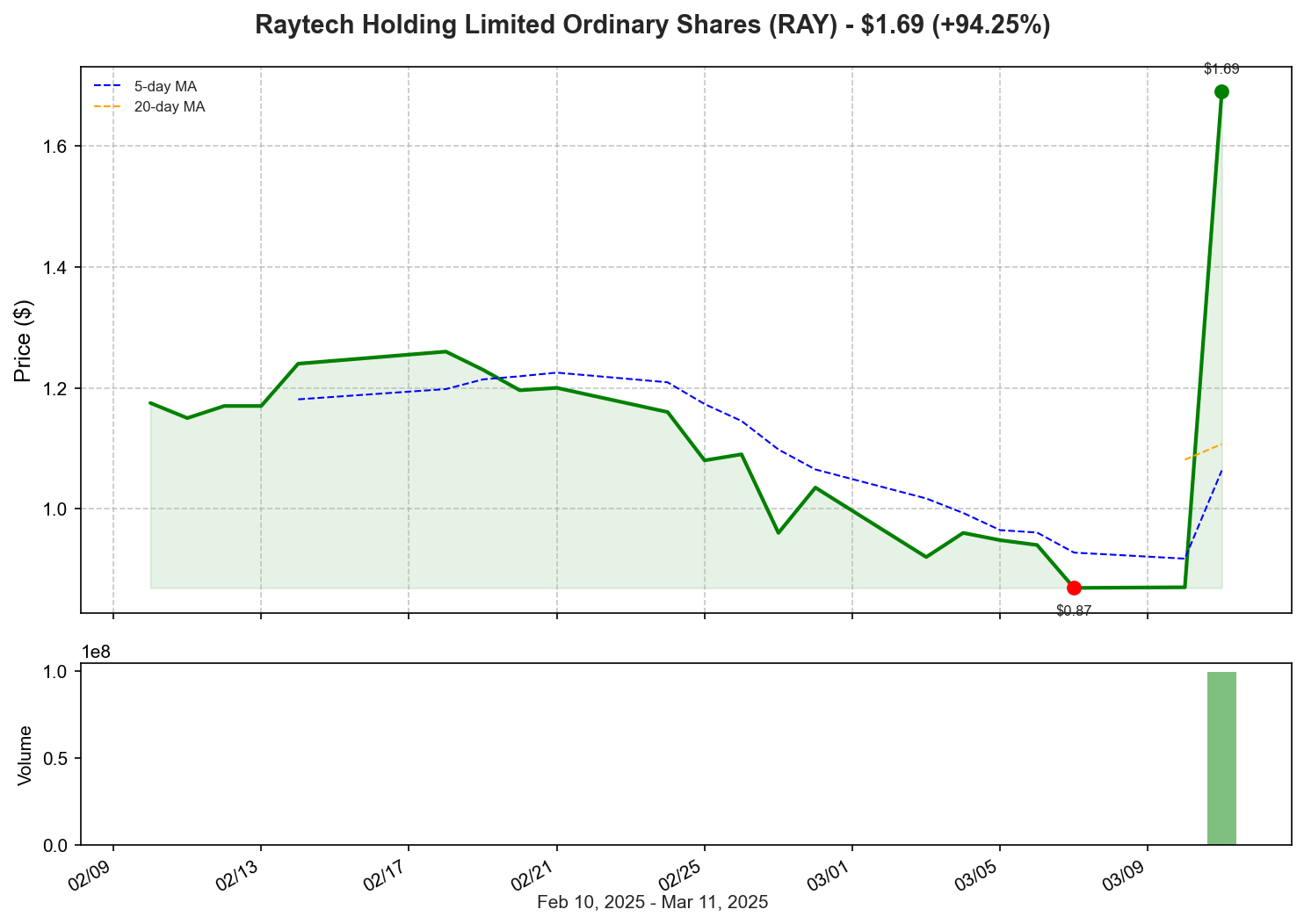

1. Raytech Holding Limited (RAY) - Up 94.25%

The extraordinary surge in Raytech's share price represents the most significant movement among today's outperformers. Operating in the Consumer Defensive sector, specifically in Household & Personal Products, Raytech's nearly 95% gain follows an already impressive 83.70% increase over the past week. With a relatively small market capitalization of approximately $30 million, such dramatic price movement likely stems from company-specific news rather than sector trends. While no specific news was provided, possible catalysts could include acquisition interest, major contract announcements, or significant product innovations. The continued momentum suggests a fundamental shift in market perception of the company's prospects rather than merely speculative trading.2. Invesco ESG Revenue ETF (ESGL) - Up 9.93%

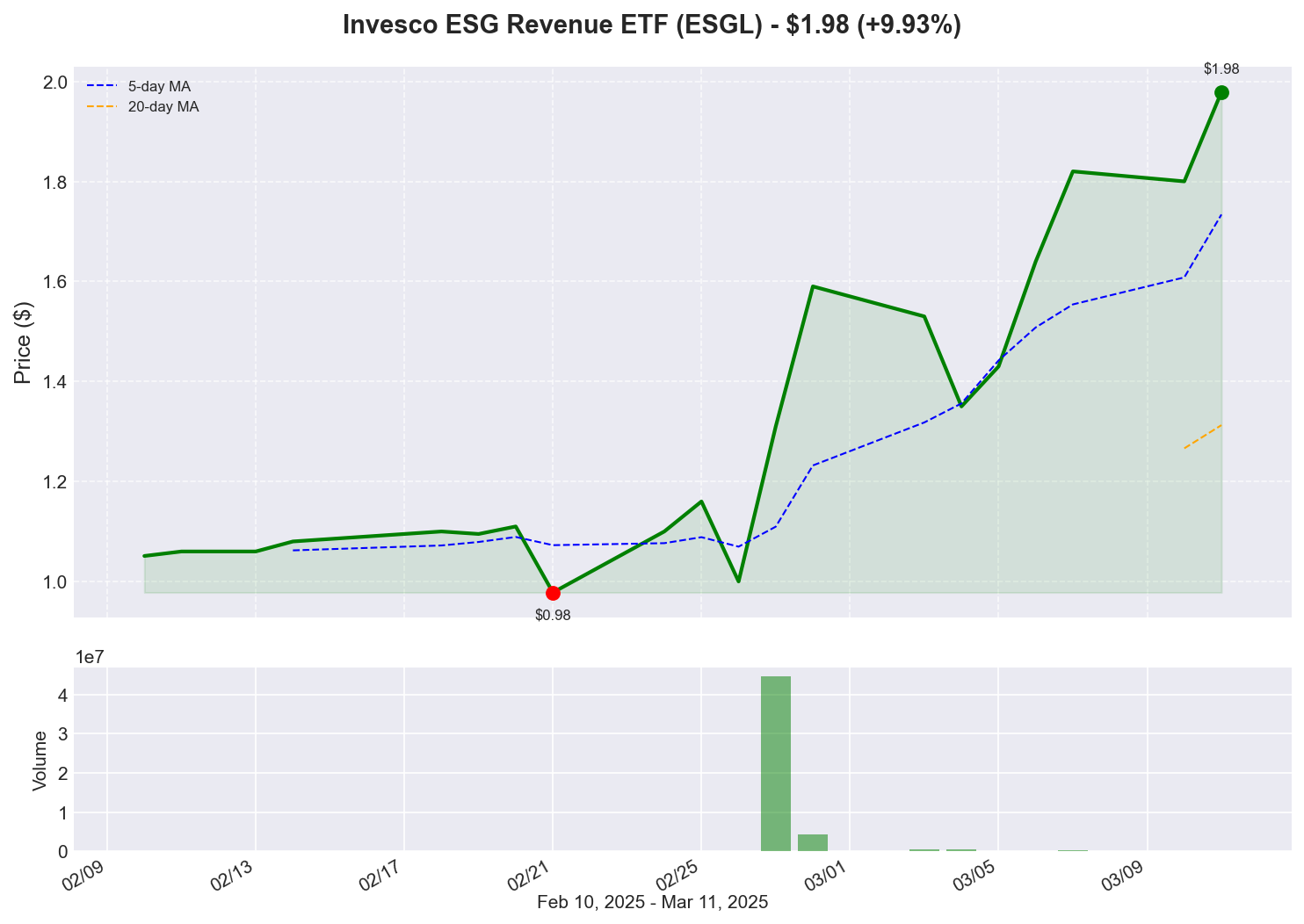

ESGL's strong performance today builds on its 29.33% gain over the past week, indicating sustained positive sentiment. The recent announcement of a definitive share purchase agreement with De Tomaso Automobili Holdings Limited on March 4th appears to be a significant catalyst driving investor interest. This ETF, focusing on environmental, social, and governance criteria within the Industrials sector, is benefiting from the growing emphasis on sustainable investments. The agreement with De Tomaso, a luxury automotive brand, suggests strategic expansion that investors are viewing positively. With a market cap of around $80 million, this ETF is still relatively small but gaining attention in the ESG investment space.3. Phoenix Motor Inc. (PEV) - Up 9.93%

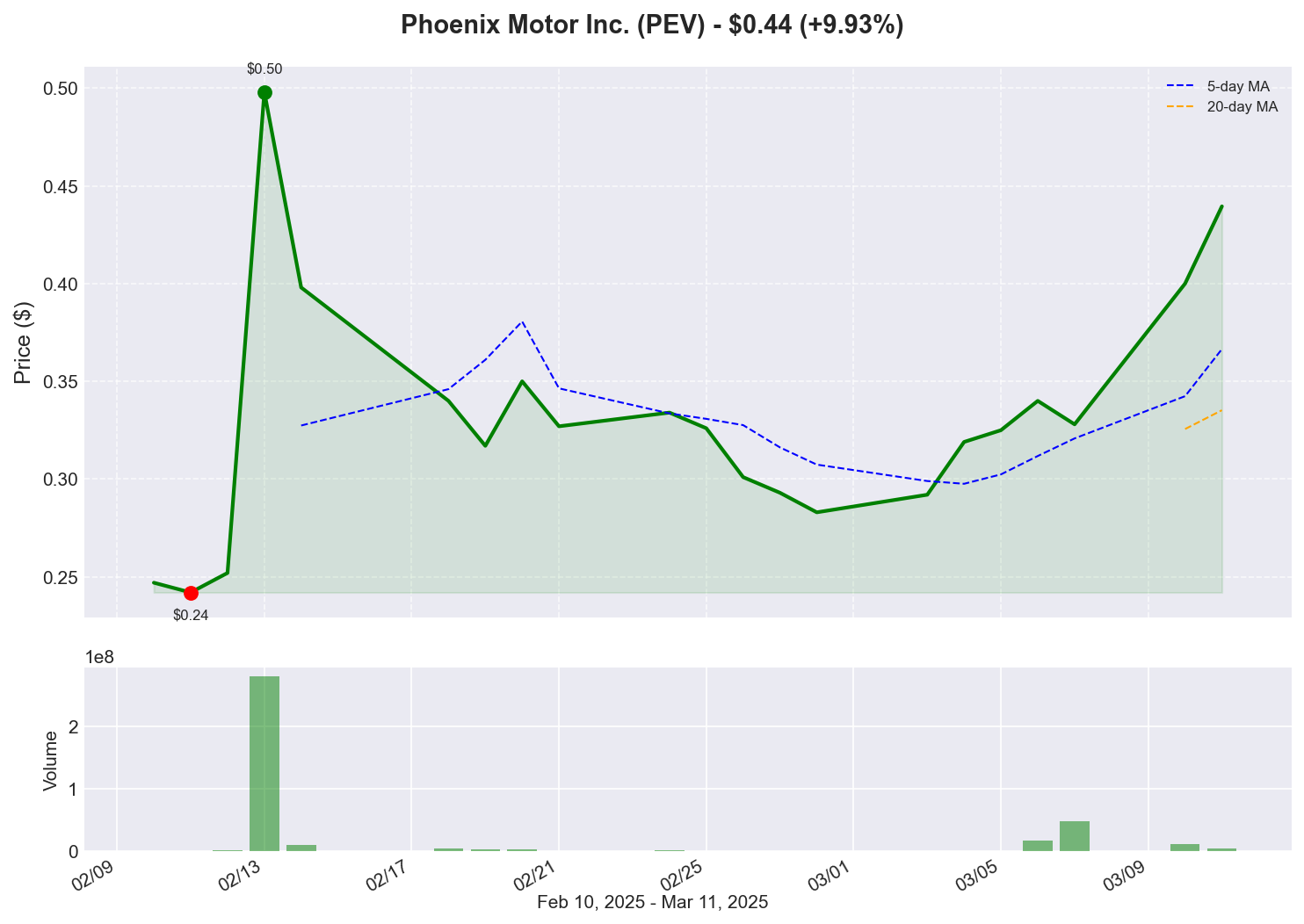

Phoenix Motor's nearly 10% gain today continues a strong 50.51% upward trend over the past week. The company's recent announcement projecting record revenue growth and profitability in 2024, with further expansion anticipated in 2025, has clearly resonated with investors. As an electric vehicle manufacturer, Phoenix is positioned in a growth sector despite recent volatility in EV stocks. The company's recent investor webinar and Q&A session likely provided additional confidence in management's strategic direction. With a small market cap of approximately $20 million, Phoenix represents a speculative but potentially high-growth opportunity in the transition to electric vehicles.4. Credo Technology Group Holding Ltd (CRDO) - Up 9.91%

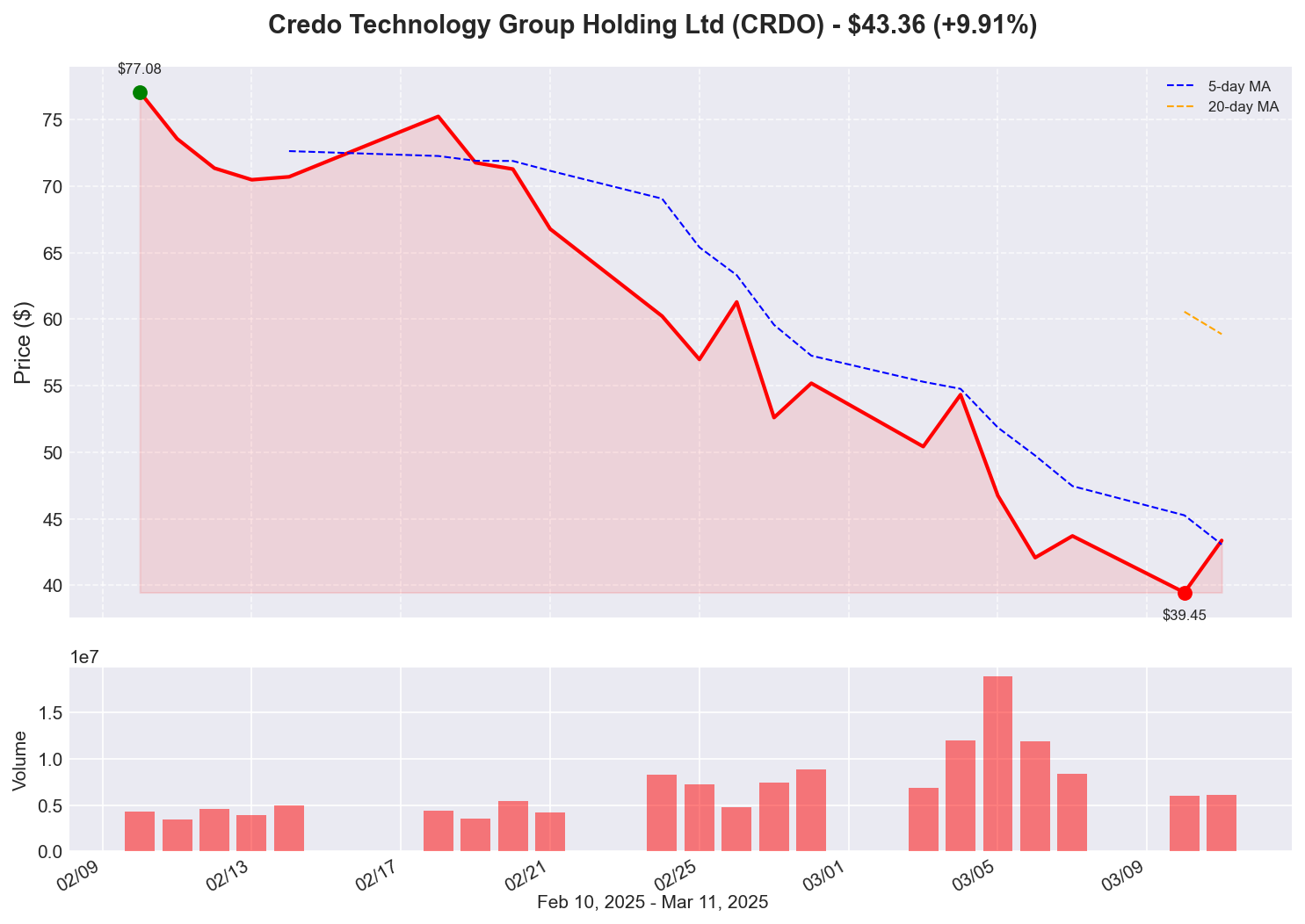

Credo Technology's strong performance today comes despite a 14% decline over the past week, suggesting a significant reversal in sentiment. As a semiconductor company with a substantial $7.25 billion market capitalization, Credo stands out as the largest company among today's top performers. Recent analyst coverage has been positive, with Credo being included in Zacks' "Best Momentum Stocks" and "New Strong Buy Stocks" lists. The recent analysis highlighting Credo's hyperscaler concentration as a strength rather than a weakness may have shifted investor perception. This performance suggests renewed confidence in Credo's positioning within the critical semiconductor space that powers AI and data center infrastructure.5. Freightos Limited (CRGO) - Up 9.90%

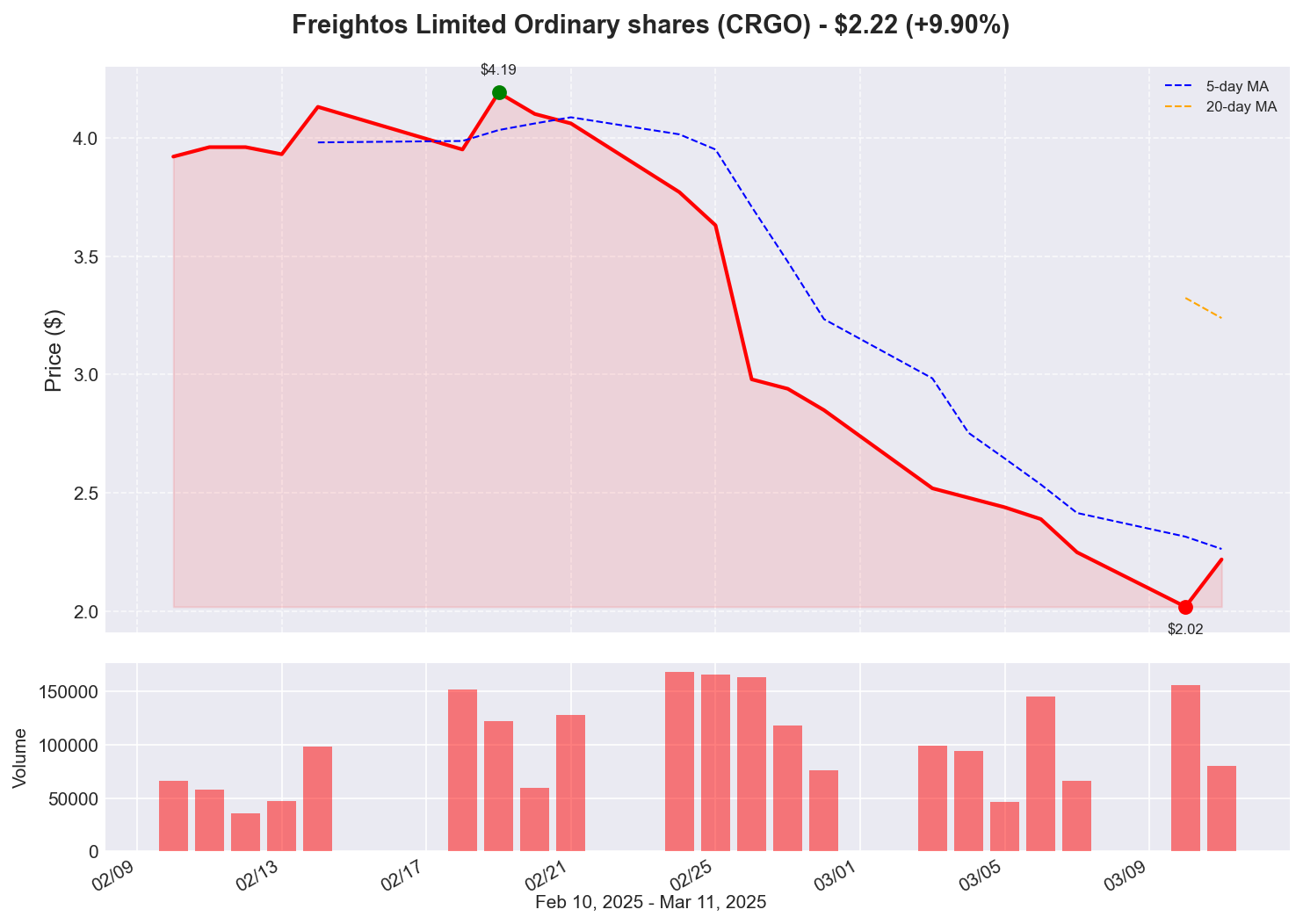

Freightos' strong performance today represents a notable reversal from its 11.90% decline over the past week. Operating in the Integrated Freight & Logistics industry, this rebound may reflect changing perspectives on global trade and supply chain dynamics. With a market cap of approximately $110 million, Freightos operates in a critical infrastructure segment that benefits from growing e-commerce and global trade flows. While no specific news was cited, the logistics sector is sensitive to macroeconomic indicators and international trade developments, suggesting potential positive developments in these areas.6. Gyre Therapeutics, Inc. (GYRE) - Up 9.87%

Gyre Therapeutics' strong performance today stands out against its relatively flat performance (-0.70%) over the past week. As a biotechnology company with a substantial market cap of approximately $974 million, Gyre represents one of the larger small-cap opportunities in the biotech space. While no specific news was provided, this movement likely reflects developments in Gyre's clinical pipeline or potential partnership announcements. Biotech stocks often move significantly on clinical trial results or regulatory developments, and today's price action suggests positive sentiment regarding Gyre's therapeutic prospects.7. Aprea Therapeutics, Inc. (APRE) - Up 9.87%

Aprea Therapeutics' performance today was directly catalyzed by its announcement of an agreement with MD Anderson Cancer Center to explore APR-1051 as a potential treatment for Head and Neck Squamous Cell Carcinoma (HNSCC). This represents a significant expansion of Aprea's clinical development program. With a micro-cap valuation of approximately $13.3 million, Aprea represents a speculative but potentially high-reward investment in the oncology space. The collaboration with a prestigious cancer center like MD Anderson adds credibility to Aprea's therapeutic approach and expands its potential market opportunities, justifying today's strong market reaction.

8. GraniteShares 1.75x Long BABA Daily ETF (BABX) - Up 9.85%

This leveraged ETF focusing on Alibaba Group continues its strong recent performance, with today's gain building on an 11.54% increase over the past week. The product provides magnified exposure (1.75x) to Alibaba's stock movements, amplifying both gains and losses. Recent coverage highlighting the strong performance of China ETFs year-to-date suggests broader investor interest in Chinese equities. Today's movement likely reflects positive sentiment toward Alibaba specifically and Chinese tech stocks more broadly, potentially driven by policy developments in China, international trade relations, or company-specific factors affecting Alibaba's outlook.9. Teva Pharmaceutical Industries Limited (TEVA) - Up 9.85%

Teva's significant move today coincides with management's presentation at the Barclays 27th Annual Global Healthcare Conference. As one of the world's largest generic drug manufacturers with an $18.5 billion market capitalization, Teva's movement affects the broader pharmaceutical sector outlook. The company appears to be navigating the balance between growth in its branded drug business and challenges in its generic portfolio, including potential headwinds from the Inflation Reduction Act's drug pricing provisions. Today's strong market reaction suggests management may have provided reassuring guidance during the conference presentation, potentially regarding pricing power, pipeline developments, or strategic initiatives.10. Bit Digital, Inc. (BTBT) - Up 9.72%

Bit Digital's performance today continues modest positive momentum over the past week (3.04%). As a cryptocurrency mining company, Bit Digital's stock price is often correlated with Bitcoin and broader cryptocurrency market trends. The company's upcoming financial results announcement may have prompted positioning ahead of the release. With cryptocurrency markets showing signs of stabilization and growth in early 2025, companies like Bit Digital with direct exposure to digital asset mining are benefiting from renewed investor interest. With a market cap of approximately $364 million, Bit Digital represents a mid-sized player in the crypto mining space.Conclusion

Today's outperformers reflect several key market themes developing in early 2025: 1. Healthcare Innovation Focus: The strong representation of biotech and pharmaceutical companies (GYRE, APRE, TEVA) signals continued investor interest in healthcare innovation, particularly in oncology and specialty drugs. 2. Technology Resilience: Despite recent volatility in tech stocks, Credo's performance demonstrates continued appetite for quality semiconductor companies supporting critical infrastructure. 3. Sustainable Transportation Growth: The strong performances of Phoenix Motor and ESGL (with its De Tomaso connection) highlight ongoing investor interest in the electrification of transportation and sustainable initiatives. 4. Small Cap Opportunity: Many of today's outperformers have relatively small market capitalizations, suggesting some investors are looking beyond large-cap names for growth opportunities. 5. China Exposure Interest: The performance of the GraniteShares Alibaba ETF points to renewed interest in certain Chinese equities after a period of uncertainty. The diversity of sectors represented in today's outperformers suggests selective stock picking based on company-specific catalysts rather than broad sector rotations. Investors appear to be rewarding clear growth stories, strategic developments, and innovation across multiple industries. For the broader market outlook, these movements may indicate increasing market discrimination between companies with clear growth catalysts versus those lacking compelling narratives. The presence of both defensive sectors (Consumer Defensive, Healthcare) and growth-oriented plays (Technology, EVs) suggests market participants are balancing risk management with growth seeking as we move through the first quarter of 2025. As market participants digest these movements and the ongoing earnings season continues to unfold, attention will likely focus on whether these companies can sustain their momentum and translate today's price appreciation into longer-term performance.

Featured Stocks

Raytech Holding Limited Ordinary Shares (RAY)

N/A

['### 1. Raytech Holding Limited (RAY) - Up 94.25%', "The extraordinary surge in Raytech's share price represents the most significant movement among today's outperformers. Operating in the Consumer Defensive sector, specifically in Household & Personal Products, Raytech's nearly 95% gain follows an already impressive 83.70% increase over the past week.", "With a relatively small market capitalization of approximately $30 million, such dramatic price movement likely stems from company-specific news rather than sector trends. While no specific news was provided, possible catalysts could include acquisition interest, major contract announcements, or significant product innovations. The continued momentum suggests a fundamental shift in market perception of the company's prospects rather than merely speculative trading."]

Invesco ESG Revenue ETF (ESGL)

N/A

['### 2. Invesco ESG Revenue ETF (ESGL) - Up 9.93%', "ESGL's strong performance today builds on its 29.33% gain over the past week, indicating sustained positive sentiment. The recent announcement of a definitive share purchase agreement with De Tomaso Automobili Holdings Limited on March 4th appears to be a significant catalyst driving investor interest.", 'This ETF, focusing on environmental, social, and governance criteria within the Industrials sector, is benefiting from the growing emphasis on sustainable investments. The agreement with De Tomaso, a luxury automotive brand, suggests strategic expansion that investors are viewing positively. With a market cap of around $80 million, this ETF is still relatively small but gaining attention in the ESG investment space.']

Phoenix Motor Inc. (PEV)

N/A

['### 3. Phoenix Motor Inc. (PEV) - Up 9.93%', "Phoenix Motor's nearly 10% gain today continues a strong 50.51% upward trend over the past week. The company's recent announcement projecting record revenue growth and profitability in 2024, with further expansion anticipated in 2025, has clearly resonated with investors.", "As an electric vehicle manufacturer, Phoenix is positioned in a growth sector despite recent volatility in EV stocks. The company's recent investor webinar and Q&A session likely provided additional confidence in management's strategic direction. With a small market cap of approximately $20 million, Phoenix represents a speculative but potentially high-growth opportunity in the transition to electric vehicles."]

Credo Technology Group Holding Ltd (CRDO)

N/A

['### 4. Credo Technology Group Holding Ltd (CRDO) - Up 9.91%', "Credo Technology's strong performance today comes despite a 14% decline over the past week, suggesting a significant reversal in sentiment. As a semiconductor company with a substantial $7.25 billion market capitalization, Credo stands out as the largest company among today's top performers.", 'Recent analyst coverage has been positive, with Credo being included in Zacks\' "Best Momentum Stocks" and "New Strong Buy Stocks" lists. The recent analysis highlighting Credo\'s hyperscaler concentration as a strength rather than a weakness may have shifted investor perception. This performance suggests renewed confidence in Credo\'s positioning within the critical semiconductor space that powers AI and data center infrastructure.']

Freightos Limited Ordinary shares (CRGO)

N/A

['### 5. Freightos Limited (CRGO) - Up 9.90%', "Freightos' strong performance today represents a notable reversal from its 11.90% decline over the past week. Operating in the Integrated Freight & Logistics industry, this rebound may reflect changing perspectives on global trade and supply chain dynamics.", 'With a market cap of approximately $110 million, Freightos operates in a critical infrastructure segment that benefits from growing e-commerce and global trade flows. While no specific news was cited, the logistics sector is sensitive to macroeconomic indicators and international trade developments, suggesting potential positive developments in these areas.']